property tax assistance program montana

The department is statutorily required to determine. Providing an Unrivaled Customer Experience for Over 20 Years.

Taxes Fees Montana Department Of Revenue

Financial assistance in the form of a grant to prevent property tax foreclosure or remove or prevent creation of other liens HOA COA etc.

. Area VI Agency on Aging can help. The Land Value Property Tax Assistance Program for Residential Property LVPTAP helps residential property owners if the value of their land is. Montana law includes four programs to offer property tax assistance to residential property taxpayers.

Income limits are 48626 for a single person. Download or print the 2021 Montana Form PTAP Property Tax Assistance Program PTAP Application for FREE from the Montana Department of Revenue. Title 15 chapter 6 part 3 MCA.

Schedule a Free Consultation Today. General Information Apply by April 15. Two of the programs are reductions in taxable value one is an exemption for the.

Montana has a Property Tax Assistance Program PTAP that helps residents with lower income reduce the property tax. 406 444-6900 Office Locations. Contact Us To Learn More.

Depending on the marital status and income of the homeowner the tax rate is reduced by 80 50 or 30 of the normal tax rate. 1 There is a property tax assistance program that provides graduated levels of tax assistance for the purpose of. Qualifying for this program may reduce your property tax.

Montana Disabled Veteran Property Tax Relief Application Form MDV 2022. Property tax assistance program -- fixed or limited income. Contact Customer Service Helena Office.

The Montana property tax system provides support for local public services including funding for schools roads and other infrastructure. MT QuickFile is for filing a Montana State. July 2 2021.

Property Tax Assistance Program Application Form PTAP 2022. 4219401 PROPERTY TAX ASSISTANCE PROGRAM PTAP AND MONTANA DISABLED VETERAN MDV PROPERTY TAX ASSISTANCE PROGRAM 1 The property owner. Property tax assistance -- rulemaking.

1 The requirements of this section must be met for a taxpayer to qualify for property tax assistance under 15-6-305 or 15-6-311. Ad Real Tax Solutions For Real People. What You Should Know About the Montana Property Tax Relief.

PTAP is designed to assist citizens of Montana who are on a limited or fixed income. For more information about qualifications or to download an application form visit revenuemtgov. We Have A Three-Phase Tax Relief Program That Shows Better Results Than Any Other Firm.

Residential property owners pay. PTAP provides this assistance to these individuals by reducing the property tax rate that is on the. The property tax assistance program for those with a fixed or limited income and the property tax assistance program for disabled veterans are provided for in.

We would like to show you a description here but the site wont allow us. January 1 2020 is the valuation date. Get Funding For Rent Utilities Housing Education Disability and More.

The following chart shows the 2017 income guidelines. Ad Achieve Property Tax Compliance Avoid Penalties. Property Tax Assistance Program PTAP Application for Tax Year 2018 15-6-305 MCA Part I.

Ad Get Assistance for Rent Utilities Education Housing and More. The market value of all residential commercial and industrial real property every two years. For an unmarried surviving spouse your income needs to be less than 42392.

Adoption Notice PDF 20 KB Proposal Notice PDF 48 KB. 56107 for married or head of household. Property Tax Assistance Programs.

You have to meet income and property.

Taxes Fees Montana Department Of Revenue

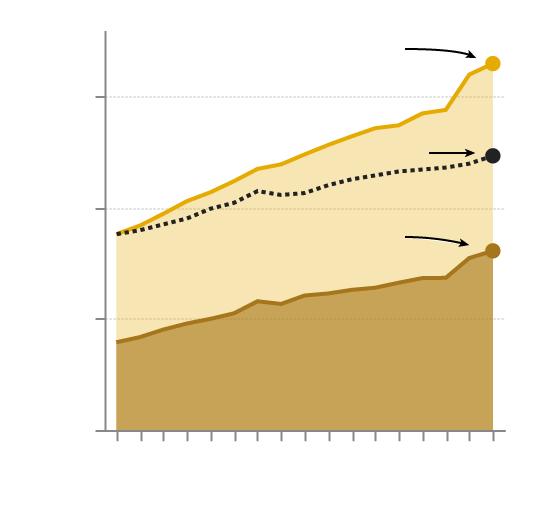

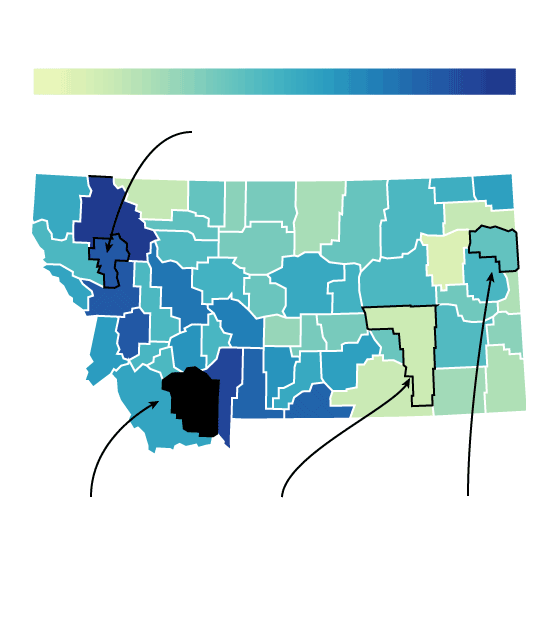

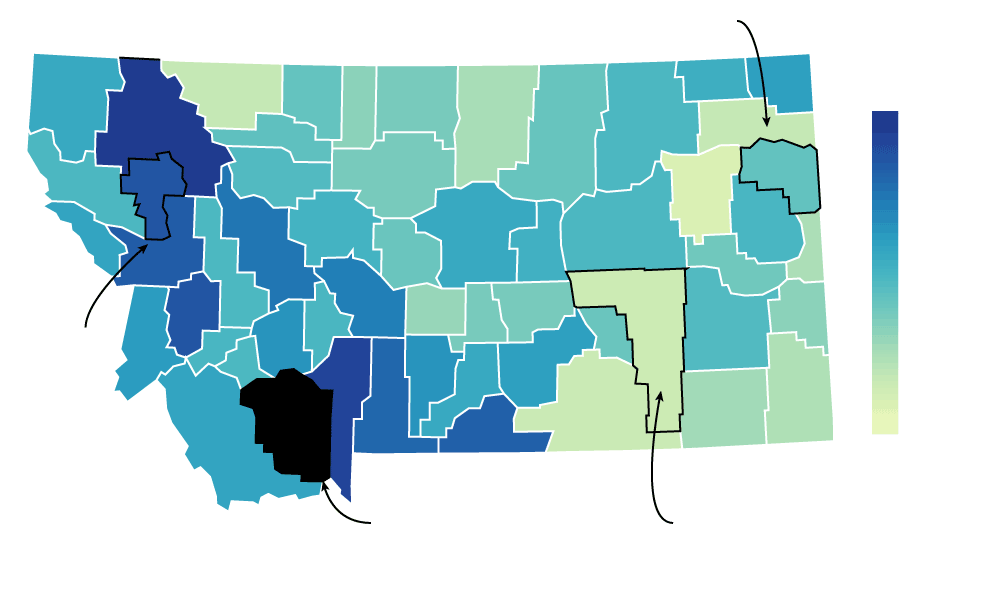

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Montana Lawmakers Vote Unanimously To Oppose Property Tax Cap Initiative Montana Public Radio

State And Local Sales Tax Rates 2013 Map Property Tax Income Tax

Taxes Fees Montana Department Of Revenue

Tax Breaks For Montana Property Owners Inspect Montana

Montana Income Tax Information What You Need To Know On Mt Taxes

Ci 121 Montana S Big Property Tax Initiative Explained

Ci 121 Montana S Big Property Tax Initiative Explained

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Chart Current Mortgage Closing Costs Listed By State Closing Costs Mortgage Interest Mortgage

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press

Taxes Fees Montana Department Of Revenue

Taxes Fees Montana Department Of Revenue